In July, the Federal Deposit Insurance Corporation gave a commercial bank focused on lending to women-owned businesses conditional approval to become Chicago’s first start-up bank in ten years. Enter female-led First Women’s Bank. Its co-founders Lisa Kornick and Marianne O’Brien Markowitz saw a gap in the market. Their experiences of applying for loans to fund their own entrepreneurial ventures or supporting small businesses access capital influenced them to launch the bank.

Kornick is a co-owner of DMK Burger Bar. Markowitz worked for the US Small Business Administration (SBA) at several points during her career and was Chief Financial Officer for Obama for America. Both understand the challenges such as the documentation involved that women face in accessing loans to fund or grow their businesses. According to BoardEx data, the bank’s chairman Amy Fahey spent most of her career to date in banking – she worked at JP Morgan Chase in various roles.

First Women’s Bank will be focused on lending to women from hair salons to consulting firms. The bank is adopting an ecosystem and platform approach to offer products and services to small businesses, people and corporations via partnerships focused on promoting gender equality and inclusion.

The bank which is still in formation stage and in the process of raising capital announced several appointments to the board. Nickol Hackett of the Joyce Foundation started at the bank on 17 July 2020. Private equity investor Kim Vender Moffat of Rosa Partners is Executive Sponsor to the Advisory Board and Meredith O’Connor of Jones Lang LaSalle will chair the advisory board. The bank has also hired from within banking and professional services. In January 2020, Maria Tabrizi joined as Chief Risk Officer and Tod Gordon, who also worked at JP Morgan Chase, was appointed Chief Financial Officer.

Financial Inclusion and Board Diversity

While First Women’s Bank expects to start trading next year, their strategy of financial inclusion fits with current times where economies are struggling, on the verge of or in recession. The debate and dialogue on diversity and inclusion is happening in a challenging business environment where banks expect to tighten lending. This will affect small business owners who are already under pressure to keep their enterprises afloat as they try to bridge financial deltas created by the ongoing health pandemic. Large US banks are building their reserves in preparation for loan defaults.

Seventy per cent of First Women’s Bank’s board members are women. Private organizations such as First Women’s Bank currently face less scrutiny than public organizations from advisors, investors, shareholders, and other partners for their demonstrable commitment to diversity and inclusion. So, BoardEx analyzed the percentage of women on the boards of public banks in the US to see how the gender diversity of their boards compared.

Percentage of Women on Boards in Public Banking Organizations in the US

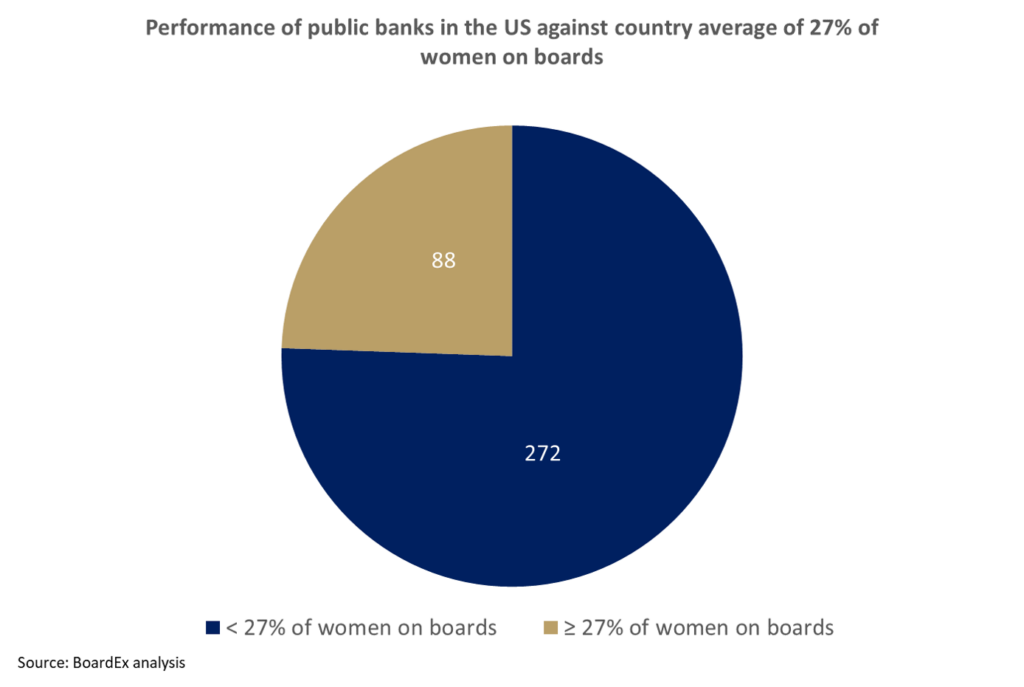

The US ranks 17 for female representation out of the 26 countries analyzed in our global gender diversity report. It is also one of six countries with a mean percentage of 27% of women on boards in listed companies – read the report to find out which other countries made this list. When applied to public organizations in the banking sector, only 88 out of 360 perform on this average – see chart below ‘Performance of public banks in the US against country average of 27% of women on boards’.

Twenty-nine of these organizations have 0% of women on their boards. The percentage for women on boards in these banking organizations ranges between 6% and 50%. All but one in the top ten US public banks by market capitalization perform on or above the average of 27%. The bank that performs below this average with women making up 25% of its board is the fourth largest bank by market capitalization.

Summary

The continuing health pandemic is impacting people and businesses hard. Economies are struggling and banks are preparing for a credit crisis in a time where businesses will need financial support. This raises questions for banks on how they can be financially inclusive while protecting their business.

First Women’s Bank is on a journey to promote inclusion in financial services primarily for women and small businesses and building a female team to serve the underserved. Will we see more banks like First Women’s Bank emerge? This private commercial bank is led by a board composed of 70% women. The mean percentage for women on boards in listed companies in the US is 27%. Based on publicly available data, our analysis of women on boards for 360 public banking organizations reveals variations in the percentage of women on their boards. In addition, more than 70% of these banks have boards with less than 27% of women on them.

Read our global gender diversity report for more country, sector and index analysis of gender diversity on boards. Find out more about how we help clients in Commercial Banking.